View cart “Taxation With MCQs CA Inter By CA Jaspreet Singh Johar May & Nov. 2024” has been added to your cart.

Scanner Paper – 3 CA Inter Taxation May 2024 Exam Shuchita Prakshan

₹610.00

SKU:

2405ICA309

Category: Taxation

Description

Additional information

| Weight | 1 kg |

|---|---|

| Binding |

Paper Back |

| Book Author | |

| Edition |

87th Edition |

| ISBN |

9789355864406 |

| HSN |

49011010 |

| Language |

English |

| Publisher |

Shuchita Prakashan |

Reviews (0)

Be the first to review “Scanner Paper – 3 CA Inter Taxation May 2024 Exam Shuchita Prakshan” Cancel reply

Shipping & Delivery

MAECENAS IACULIS

Vestibulum curae torquent diam diam commodo parturient penatibus nunc dui adipiscing convallis bulum parturient suspendisse parturient a.Parturient in parturient scelerisque nibh lectus quam a natoque adipiscing a vestibulum hendrerit et pharetra fames nunc natoque dui.

ADIPISCING CONVALLIS BULUM

- Vestibulum penatibus nunc dui adipiscing convallis bulum parturient suspendisse.

- Abitur parturient praesent lectus quam a natoque adipiscing a vestibulum hendre.

- Diam parturient dictumst parturient scelerisque nibh lectus.

Scelerisque adipiscing bibendum sem vestibulum et in a a a purus lectus faucibus lobortis tincidunt purus lectus nisl class eros.Condimentum a et ullamcorper dictumst mus et tristique elementum nam inceptos hac parturient scelerisque vestibulum amet elit ut volutpat.

Related products

Income Tax CA Raj K Agrawal CA / CS / CMA Inter May & Nov. 2024

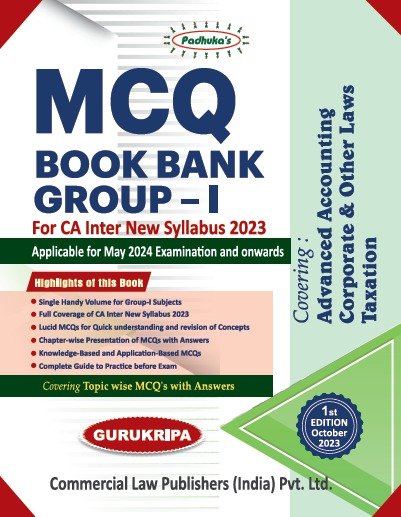

Padhuka MCQ Book Bank (Group – 1) CA Inter May 2024

Knowledge based and Application Based MCQs

- - - - Highlights - - -

- Single Handy Volume for Group-l Subjects

- Full Coverage of CA Inter New Syllabus 2023

- Lucid MCQs for Quick understanding and revision of Concepts

- Chapter-wise Presentation of MCQs with Answers

- Knowledge-Based and Application-Based MCQs

- Complete Guide to Practice before Exam

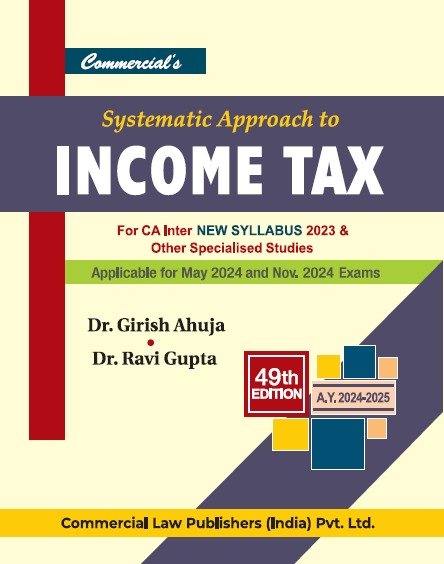

Systematic Approach To Income Tax CA Inter (Dr. Girish Ahuja Dr. Ravi Gupta) May & Nov. 2024 Exam

Systematic Approach To Taxation Containing Income Tax & GST CA Inter Dr. Girish Ahuja Dr. Ravi Gupta May & Nov. 2024

Main Features -

- It is user-friendly and provides information in a concise manner.

- It is a comprehensive and critical study of the law relating to Income Tax and GST

- Even the last minute changes in the law have been incorporated in the book and it is, therefore, the latest and most up-to-date book for the Assessment Year 2024-2025 The amendments made by the Finance Act 2023 have been given at appropriate places in the book. The Highlights of Amendments made by the Finance Act, 2023 have also been given in the beginning of the book to facilitate a quick glance to the readers about the latest.

- All important case-laws and circulars /notifications have been incorporated.

Reviews

There are no reviews yet.